by Webmaster | Jan 14, 2015 | Real Estate News

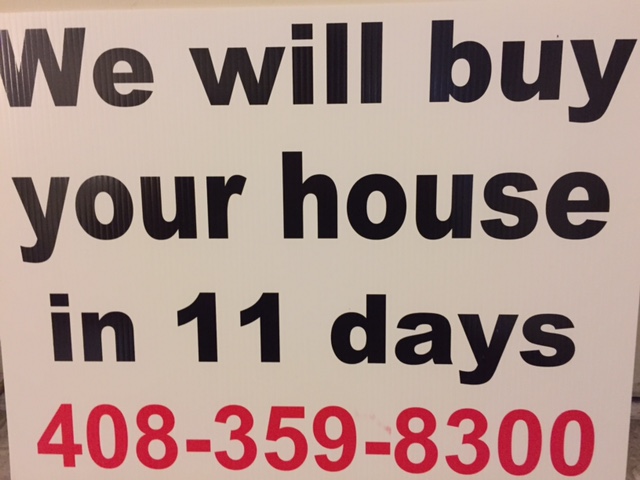

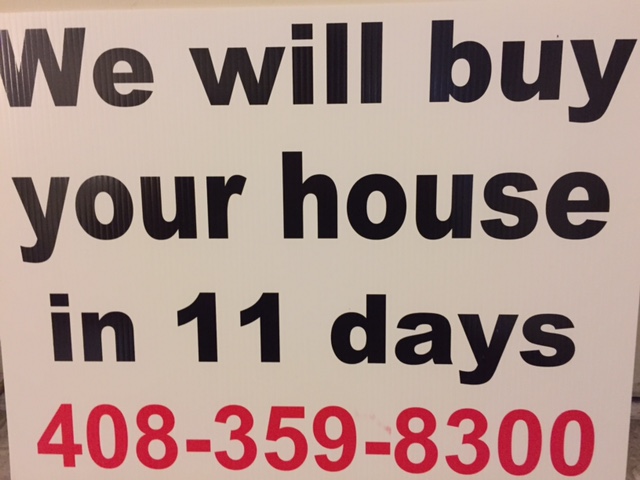

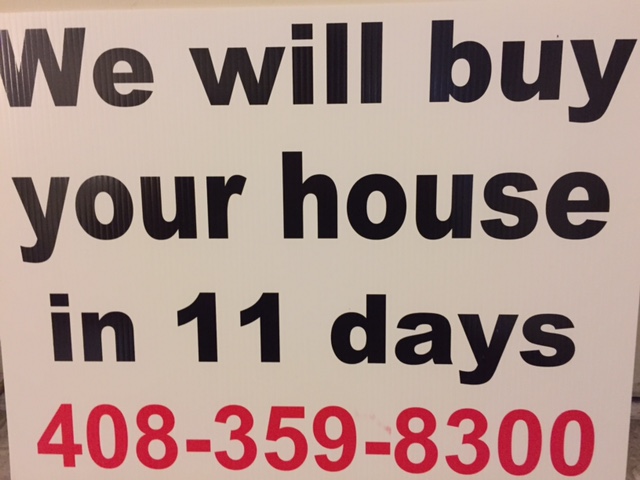

As mentioned in a previous blog, bandit signs can be a very effective way to get your phone to ring with potential home sellers. With that said, it is important to note that as the name implies, there are some legal risks in using bandit signs. Given the usefulness of this strategy, I believe it is worthy of an entire blog. A few basic items are worth noting. Less is better. That means that you want to make the message short and simple, so drivers can actually read it as they are driving by. Messages like “We buy houses for cash” or “Sell your house in 9 days” will work fine. Of course, it is best if you can find a telephone number that is easy to remember. Busy intersections provide the greatest number of eyeballs on your signs. The key is to space them out so they are not obnoxious. Posting too many signs in any given area is inviting problems and complaints. Last, hang them as high as possible, so they are not easily taken down or vandalized. To get started, you need to figure out where are the best areas to hang signs. The obvious answer is to hang them where the highest number of potential distressed properties might be. I suggest doing some on-line research to track the following two metrics: 1. Identify zip codes with the lowest DOM (days on market). This is where homes are selling fastest. 2. Identify zip codes where the median home price is below the city’s median home price. If you can narrow down the zip codes that match...

by Gagner | Jan 7, 2015 | Real Estate News

Recently, I had the pleasure of being interviewed by Joe Fairless, host of the nationally syndicated “Best Real Estate Advice Ever” show and podcast. We spoke about a range of topics, focusing on raising money for my various real estate businesses and the basics on syndicating apartment deals. Sticking to his fixed format, I was also able to share my best experiences and resources to the audience. To hear the interview, click on the following link: http://goo.gl/JHHgJl. As I shared the story about getting my real estate business started in 2010, I made sure to let the audience know that the most important advice for beginners is to just take action, even if you are not certain all your goals or objectives. Reading books and pursuing my real estate license were the first steps I took, even though I was not sure at the time exactly how or where I was going to invest. The experience taught me that the right people and resources will be met along the way if you are making forward progress each day. As the conversation shifts to my fix and flip business, we speak about how I use “other people’s money” to finance that aspect of my business, freeing up money to invest in buy/hold real estate for passive income. Structuring deals with hard money and private money has a substantial cost, so it is imperative to find good deals with adequate margin. With the right financial resources (and a little experience), a fix/flip business can be run with a relatively small amount of capital. I walk Joe thru a typical deal structure....

by Gagner | Dec 18, 2014 | Real Estate News

Bay Area Real Estate – Look to Us The Bay Area has a lot going for it and real estate is no exception. Currently, the Silicon Valley economy is firing on all cylinders, making real estate everywhere here increasingly valuable. Key factors such as population and economic growth are rising at a phenomenal pace. In addition, high barriers to entry (ie. lack of buildable land) continue to put upward pressure on home values. Unfortunately, local real estate investors looking for cash flow are victims of our area’s own success. Whether real estate investment opportunities in the Bay Area do or don’t exist, depends on your definition of opportunity. In considering the Bay Area for real estate investments, your options will be influenced by many factors, such as your desire for passive vs active income, risk tolerance, yield expectations and investment horizon. Depending on your goals and resources, it may or may not make sense for you to invest in the Bay Area. The following are a few suggestions to consider. Active real estate investors can certainly take advantage of the rising market to earn great returns on wholesale or fix and flip projects. To pursue these strategies, one must develop the resources, know-how and relationships to be successful. This does take a fair amount of time and risk to execute profitably. The largest challenge for most investors doing this today (me included) is finding “the deal”. The common wisdom in real estate is that you make your money when you buy, and this certainly applies to our local market. The most commonly used methods to find deals are networking,...

by Gagner | Sep 5, 2013 | Real Estate News

This past Monday, September 2, 2013, Bay Area dwellers rejoiced as the new Bay Bridge opened to travelers after final construction came to a close over the long holiday weekend. Having initiated construction on the new bridge in 2002 it only took a mere eleven years to complete the new and improved bridge project. To watch the complete San Francisco- Oakland Bay Bridge construction time lapse (in four minutes!) click, here. Looking to sell your house but don’t have that kind of time on your hands? Allow the Bridge Equity Group to assist. Connecting home sellers, home buyers, and real estate investors (in the Bay Area), Bridge Equity Group works to help you to sell quickly and efficiently. Have a property you’re looking to sell? Need to get into a new home asap? Let Bridge Equity group help you bridge the gap between where you are today and where you’d like to be...

by Gagner | Sep 5, 2013 | Real Estate News

Consider yourself a true Giants fan? Perhaps you ought to consider investing in pitcher Barry Zito’s former Marina home, which has recently hit the market at a mere $1,299,888. Originally purchased by Zito in 2002 for $715K and sold in 2006 for $765K the home contains 2 bedrooms, 1.5 baths and comes with a 1-car garage. Having undergone a recent remodel, the Marina digs feature restored architectural elements, a beautiful new chef’s kitchen, and the added bonus of Zito juju, making it a true ‘home run’. Looking to sell your home? Want to make it a faster turner around than the average market listing? Bridge Equity Group, will buy your home, for cash and fast! Now, that’s a grand slam! For more info on buying this Bay Area home visit – 3417 Divisadero.com Photo: SF...

by Gagner | Sep 5, 2013 | Real Estate News

Following on the tails of a competitive spring market, home-selling speeds fell in July according to Redfin. Their report concludes that in July 2013, 30 percent of homes went under contract within 14 days of their debut, a decrease from 31 percent in June and 33.4 percent in April. However, when compared with last year’s rate of 21.2 percent of homes under contract within two weeks in July, this year’s market is still seeing a marked improvement. According to Redfin, ‘Market speed over the past two years has slowed in July, with many homebuyers taking a break from the market for summer vacation. The seasonal effect is likely exaggerated this year, as Redfin agents across the country report that their clients have temporarily put their home searches on hold, feeling worn down by bidding wars involving as many as dozens of competing bids, not to mention rising interest rates.’ Market speed is anticipated to remain brisk in the coming months. Fun facts about the Bay Area Market: -San Jose (Silicon Valley), California was the fastest moving market, reporting 44.7 percent of homes under contract within two weeks of their debut. -California boasts itself as home of six of the nation’s 10 fastest markets, with ncluding San Jose (#1) and San Francisco (#2) leading the pack. For the full report visit...

by Gagner | Sep 5, 2013 | Real Estate News

The results are in! According to S&P/Case-ShillerHome Price Indexes, the leading measure of U.S. home prices, home prices continued to increase in June 2013. Specifically, the National index grew 7.1 percent in the second quarter and 10.1 percent over the last four quarters. The 10-city and 20-city composites posted returns of 2.2 percent for June and 11.9 percent and 12.1 percent over 12 months, respectively. Needless to say, things continue to look up for the housing market, specifically in California, namely San Francisco. ‘The Southwest and California have consistently led the recovery with Las Vegas, Los Angeles, Phoenix and San Francisco posting at least 15 months of gains’ says David M. Blitzer, Chairman of the Index Committee at S&P Down Jones Indices. According to the reports, ‘Year-over-year, Las Vegas and San Francisco were the only two MSAs to post gains of over 20%.’ For the full report visit: S&P Dow Indices. ...

by Gagner | Aug 22, 2013 | Buyers, Real Estate News

Good news for many that are still trying to recover from personal financial crisis due to the housing market crash—the FHA is reducing the amount of time a borrower must wait in order to receive an FHA-insured mortgage. According to a new mortgagee letter from the Dept. of Housing and Urban Development, eligible borrowers (including those who experienced unemployment or other economic setbacks and lost their homes to a pre-foreclosure sale, deed-in-lieu, or foreclosure) can now receive an FHA-insured loan in as little in one year as opposed to the previous three. FHA is now considering borrowers who have experienced significant economic set backs and can document that: Certain credit impairments were the result of a loss of employment or a significant loss of Household Income beyond the borrower’s control; The borrower has demonstrated full recovery from the event; and, The borrower has completed housing counseling. The guidance in the mortgagee letter is applicable to purchase money mortgages in all FHA programs, with the exception of Home Equity Conversion Mortgages. The guidance in the mortgagee letter is applicable to purchase money mortgages in all FHA programs, with the exception of Home Equity Conversion Mortgages For Borrowers who are still ineligible for an FHA-insured mortgage due to FHA’s waiting period for bankruptcies, foreclosures, deeds-in-lieu, and short sales, as well as bad credit (including collections and judgments) may still be eligible for an FHA-insured mortgage if the borrower: Can document that the delinquencies and/or indications of derogatory credit are the result of an economic event as defined in the mortgagee letter, Has completed satisfactory housing counseling, as described in this ML,...

by Gagner | Aug 17, 2013 | Real Estate News

According to an article from ABC News published Tuesday July 30, the Bay Area Real Estate market is currently booming. This bold claim was backed by the astounding figures published by the S&P/Case-Shiller index that ranks home prices in metropolitan cities. In the report, San Francisco home prices were cited as growing 25% in the last year; the biggest increase in seven years. That’s more than double the nationwide average of major cities. Read the full story...

by Gagner | Aug 14, 2013 | Real Estate News, Sellers

Asking Home Prices Cool Most in Hottest Housing Markets: Las Vegas, Oakland, and San Francisco SAN FRANCISCO, August 6, 2013 – Trulia, a leading online marketplace for home buyers, sellers, renters, and real estate professionals, today released the latest findings from the Trulia Price Monitor and the Trulia Rent Monitor. Based on the for-sale homes and rentals listed on Trulia, these monitors take into account changes in the mix of listed homes and reflect trends in prices and rents for similar homes in similar neighborhoods through July 31, 2013. Asking Home Prices Fall 0.3 Percent Month-Over-Month Asking home prices are now starting to lose steam as mortgage rates rise, inventory expands, and investor demand declines. Nationally, asking prices dropped 0.3 percent in July – the first month-over-month (M-o-M) decline since November 2012. Seasonally adjusted, prices rose 3.3 percent quarter-over quarter (Q-o-Q), down from a peak of 4.2 percent in April. Year-over-year (Y-o-Y), prices are up 11 percent nationally; however, this change is an average over the past 12 months and is therefore slower to show changes than monthly and quarterly numbers. Asking Home Prices Now Slowing Down in the West In 64 out of 100 U.S. metros, the quarterly asking home price gain was lower than in the previous quarter. This slowdown was most apparent in the West Coast where prices have rebounded strongly already. Among housing markets where asking prices rose sharply Y-o-Y, price gains dipped the most Q-o-Q in Las Vegas, Oakland, and San Francisco. Other California metros, including Sacramento, Ventura County, San Jose, and Fresno, saw Q-o-Q gains drop by at least two percentage points between April and July. Meanwhile, many metros in the South and Midwest are seeing price...